Apple has shown an almost uncanny development even without Steve Jobs. Photo: Stockphoto

On August 24th, it was ten years since Apple’s iconic founder and CEO Steve Jobs handed over the CEO position to Apple’s then chief operating officer Tim Cook.

Steve Jobs left but the phrase ”Apple’s brightest and most innovative days are ahead”. After Apple’s incomparable journey, from almost bankruptcy in the late 1990s to the world’s largest company, the statement was received with somewhat mixed comments.

When Steve Jobs died a few months later in the suites of cancer, the accidental crusts began to crash. There was only one Steve Jobs, and he was irreplaceable.

The profit has quadrupled

But the pessimists were wrong. Just over a decade later, it can be stated that Apple has survived. And more than that. The last 10 years have been a formidable success for the tech giant.

The summary below from the analysis company Morningstar are figures that are more than impressive. Sales have more than tripled and profits have quadrupled under Tim Cook’s management.

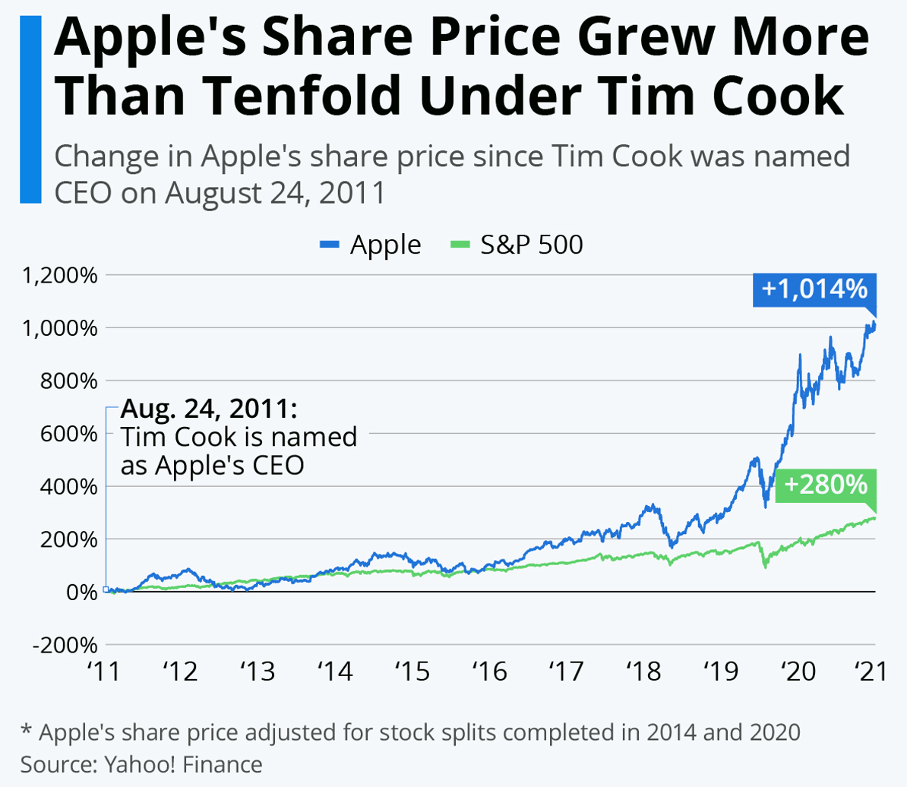

Five times better than the index

And the stock market has shown its appreciation with an unlikely price increase. Since 2011, the share price has more than tenfolded. That is almost five times better return than the index. The market capitalization is now up to approximately USD 2,500 billion.

One who is not surprised by the development is the leadership guru Jim Collins, author of the bestsellers ”Good to Great” and ”Built to Last”.

In The Investor Podcast Network We Study Billionaires – The Investor’s Podcast Network on Apple Podcasts, he posts the text on why Apple has become so successful and why Steve Jobs is not missing.

Innovations at the core

Collins believes that Steve Jobs’ most important contribution to Apple was not to invent an iphone or an ipod but to create an organization for success and innovation. That was Job’s goal.

Then came the above innovations. And this culture at Apple lives on, according to Collins, and will continue to do so even after Tim Cook leaves.